Concept of taking a broader perspective in deciding between economic choices first manifested in the 1960s during the Vietnam War, when anti-war demonstrators demanded that university endowments should stop investing in defense contractors. Concerns about slavery, apartheid and fair trade propelled this practice forward in the 1970’s. The same philosophy later spanned into other areas of critical concern such as climate change and corporate governance. The acceleration of global warming doubling from 1981 compared to rates recorded previously urged businesses to reassess the environmental impact of prevailing business practices. Furthermore, famous corporate scandals such as Enron, Freddie Mac, Lehman Brothers in the 2000s led to corporate governance becoming another pivotal area of focus for stakeholders.

Ultimately combining these areas of concern and coining them as ESG - Environmental, Social and Governance - were globally accepted as the three central factors to measure the sustainability of a business as well as an investment.

Investors do care

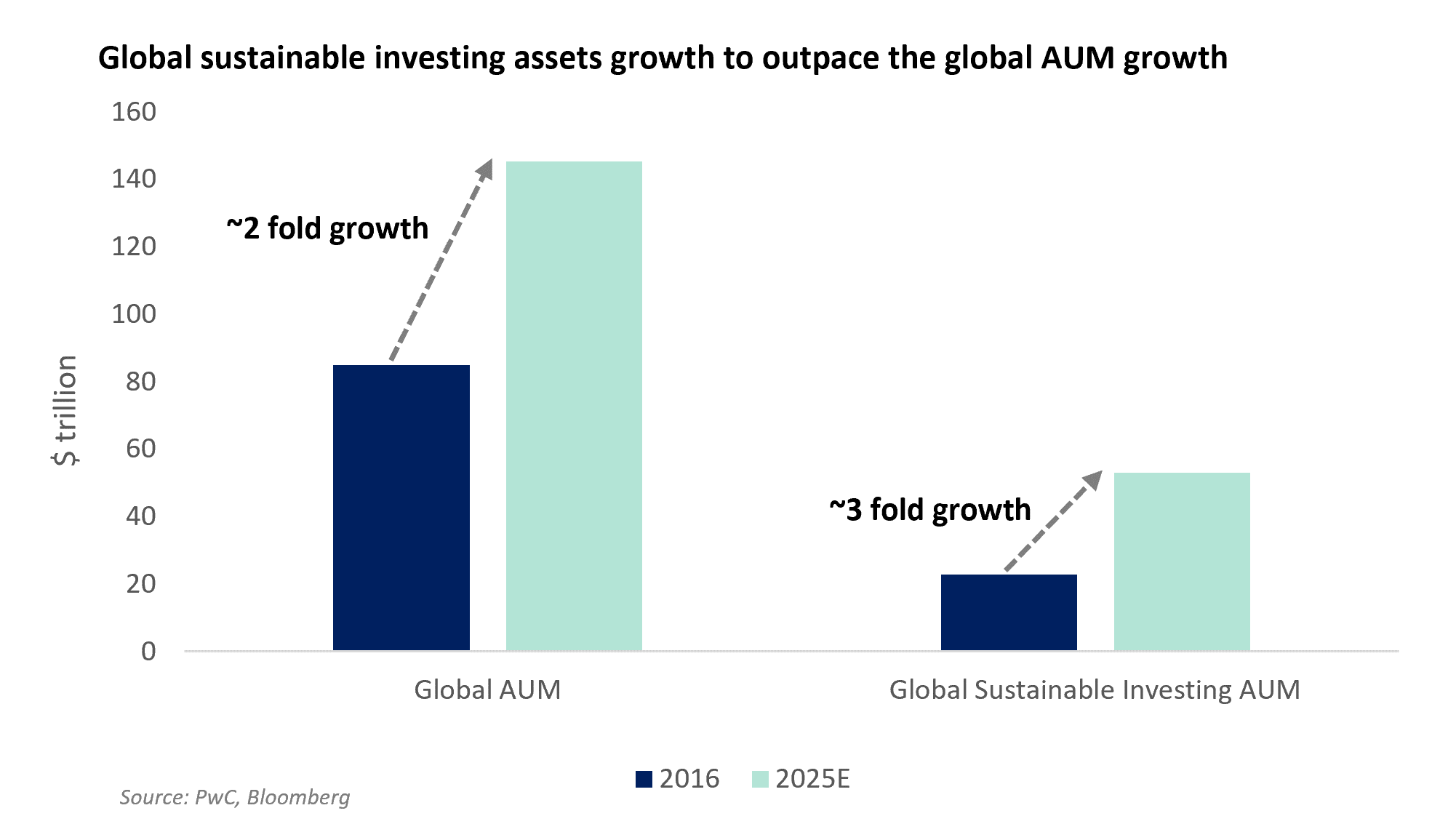

As the investing landscape gradually started to transform over time, the ESG practices were increasingly embraced by investors across the world. The valuation of global assets using ESG data to guide investment decisions have more than tripled over 2012 – 2020. It is anticipated that global assets under management is likely to double over the period of 2016 to 2025 while global sustainable investing assets to more than triple over the same period.

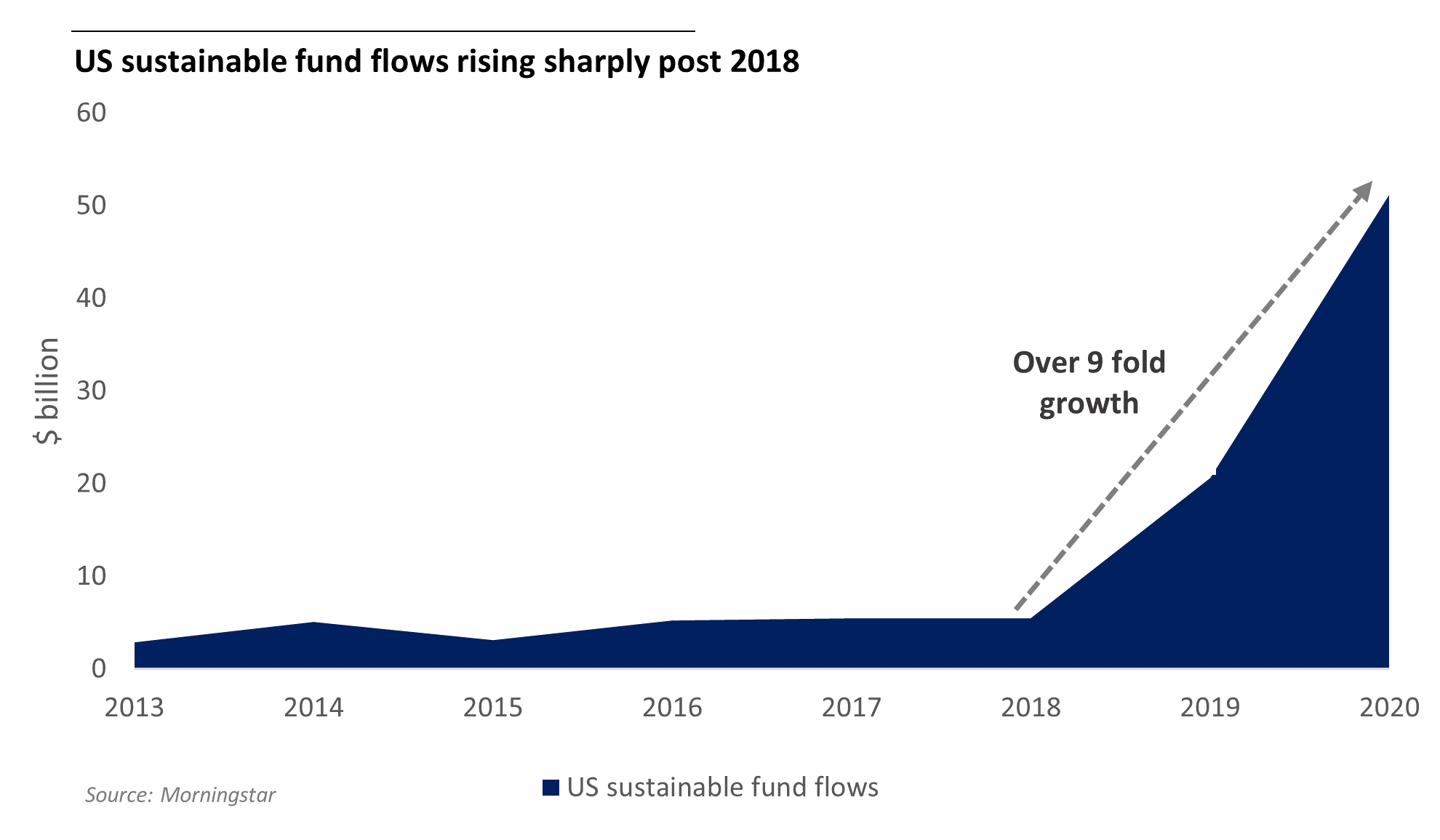

Europe was leading the global sustainable investing landscape with a dominant share; however, the US seems to be growing at a faster rate, possibly surpassing Europe in the near future. Industry tracker Morningstar in a recent study on US stock and bond funds, explained that in year 2020 nearly one-fourth of overall fund flows to the US stock and bond funds were sustainable fund flows. The recent updates indicate that the US markets have attracted a record level of sustainable fund flows in 1Q-2021.

Sustainability indices beat their traditional peers

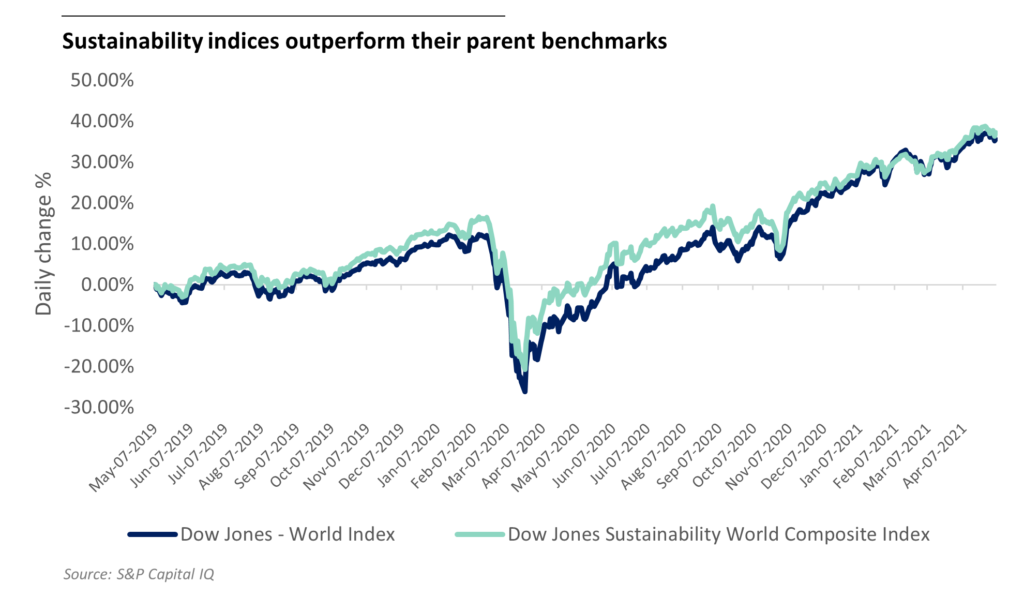

Moreover, it has been evident that sustainability indices tend to outperform the parent benchmarks in several geographies which further emphasizes the positive correlation between good ESG practices and long-term financial returns.

Largest asset managers shifting to ESG focused investments

As the ESG investing is emerging as an uptrend, the industry giants are also adapting themselves, accordingly, setting an example for everyone. In January 2021, BlackRock – the world’s largest asset manager announced that it would sell shares in the worst corporate polluters in order to help achieve the goal of net-zero carbon emissions by 2050.

In May 2021, one of the world’s top alternative asset managers – Blackstone, for the first time asked executives in companies controlled by its private equity arm to report on ESG matters to their boards on a regular basis.

Rise of green finance innovations

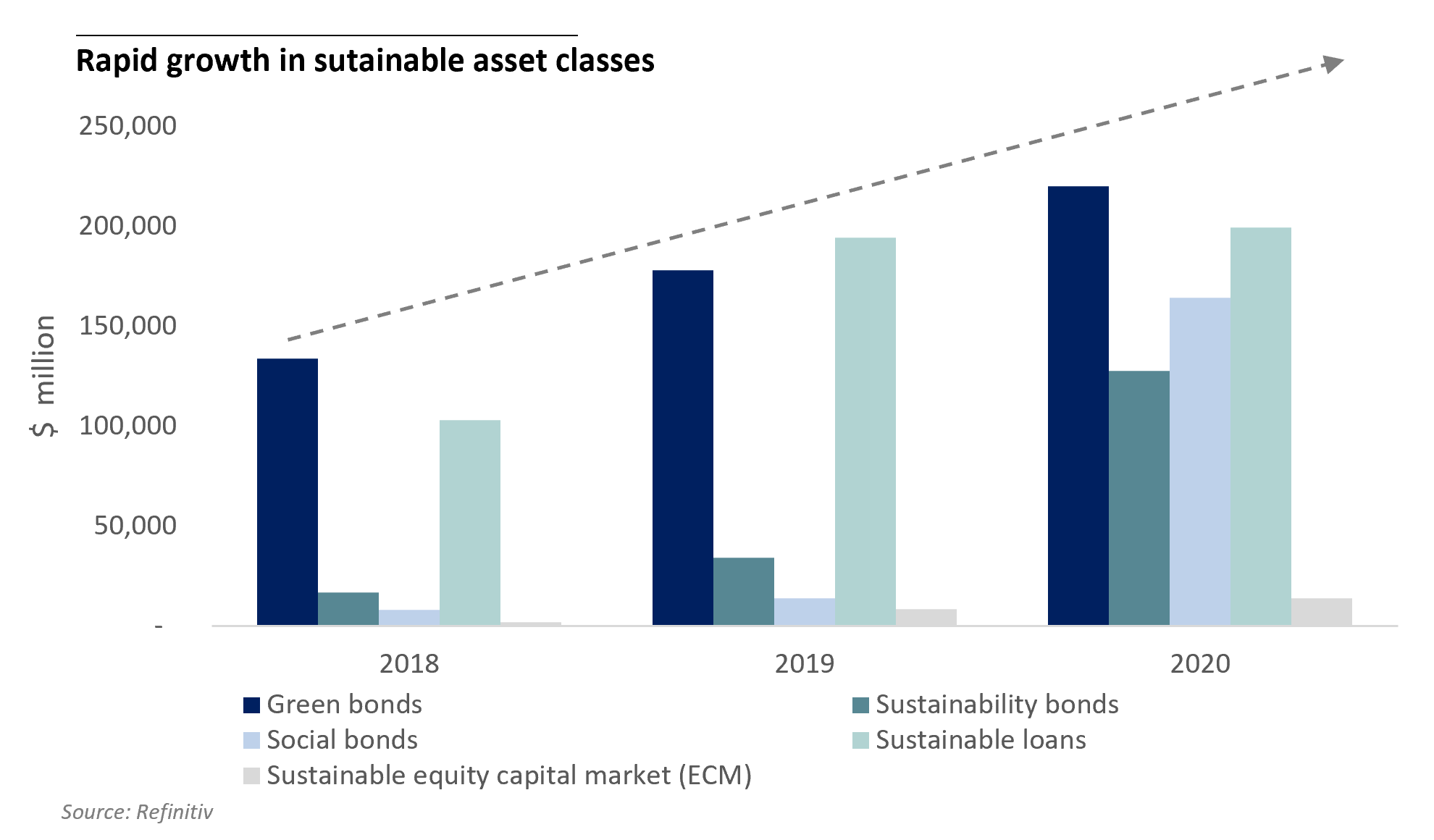

With the arrival of revolutionary ESG trends, novel sustainable asset classes have also come into light, such as green loans, green bonds, sustainability bonds, social bonds, etc., expanding the traditional financial asset universe. The Climate Bonds Initiative emphasizes on how global green bond issuance has more than tripled over 2016 – 2020. Remarkably, social bonds surged by nearly tenfold globally in 2020. Sustainable loan volumes witnessed a steady uptrend while equity issuance from sustainable companies reached an all-time high in 2020.

ESG integrity across transnational value chain

Not only the investors, but also all other internal and external stakeholders seem to be equally concerned about the ESG orientation of a business. With globalization, every company has inevitably been a part of the global value chain. For instance, when catering to a global clientele,the local company’s level of ESG adoption needs to be aligned with the clients’ ESG expectations in order to mutually thrive. The regulatory bodies across the world also express increasing interest in promoting ESG practices through implementing different initiatives.

As each and every business entity continues to be a crucial factor, exerting immense influence on the planet and its people, and in simple terms, shaping the world, their attitude towards sustainability and ESG aspects would be important as never before. Nevertheless, with the growing pressure from investors and other key stakeholders, adhering to ESG practices has already become, not an option for a business but a mandatory move, no matter how big or small it is. Businesses that do not consider these factors may face unforeseen financial risks and investor scrutiny.

Therefore, the time has come for businesses to embrace ESG genuinely instead of looking for means and ways to escape it.

References

1. Lindsey, Rebecca and Dahlman, Luann. Climate Change: Global Temperature.

Climate.gov. [Online] March 15, 2021.

https://www.climate.gov/news-features/understanding-climate/climate-change-global-temperature

2. AVCA’s Sustainability Committee Report. An Untold Story. The Evolution of Responsible Investing in Africa. [Online] April 2018. [Cited: May 27, 2021.]

https://docs.google.com/document/d/1H9y9PKQULblBB4xU9pshXA4rNkd0NMYV/edit.

3. Baker, Sophie. Global ESG-data driven assets hit $40.5 trillion. Pensions & Investments. [Online] July 02, 2020.

https://www.pionline.com/esg/global-esg-data-driven-assets-hit-405-trillion.

4. PwC Nigeria. PwC.com. Global Assets under Management set to rise to $145.4 trillion by 2025. [Online]

https://www.pwc.com/ng/en/press-room/global-assets-under-management-set-to-rise.html.

5. Bloomberg Intelligence. Bloomberg Professional Services. bloomberg.com. [Online] February 23, 2021.

https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/#:~:text=ESG%20assets%20are%20on%20track%20to%20reach%20%2453%20trillion%2C%20based,the%20category%20starting%20in%202022.

6. Stankiewicz, Alyssa. Sustainable Fund Flows Reach New Heights in 2021’s First Quarter. morningstar.com. [Online] April 30, 2021.

https://www.morningstar.com/articles/1035554/sustainable-fund-flows-reach-new-heights-in-2021s-first-quarter.

7. TMX. ESG Parent Index Benchmark. ESG Index Futures Outperform their Parent Index Benchmark. s.l. : Bourse de Montréal Inc, February 2021.

8. Jolly, Jasper. The Guarding news. The Guardian. [Online] January 26, 2021.

https://www.theguardian.com/business/2021/jan/26/asset-manager-blackrock-threatens-to-sell-shares-in-worst-climate-polluters.

9. Dinapoli, Jessica. EXCLUSIVE Blackstone asks its companies to regularly report on sustainability. Reuters.com. [Online] May 03, 2021.

https://www.reuters.com/business/sustainable-business/exclusive-blackstone-asks-its-companies-regularly-report-sustainability-2021-05-03/.

10. Chestney, Nina. Reuters Money News. Reuters.com. [Online] January 25, 2021.

https://www.reuters.com/article/greenbonds-issuance-idINKBN29U029.

11. Climate Bonds. Climate Bonds Initiative. climatebonds.net. [Online] November 11, 2017.

https://www.climatebonds.net/resources/press-releases/2017/11/2017-green-bond-issuance-passes-100-billion-new-global-green.

12. Toole, Matthew. Sustainable finance surges in 2020. Refinitiv.com. [Online] February 4, 2021.

https://www.refinitiv.com/perspectives/market-insights/sustainable-finance-surges-in-2020/.